No.2 in an occasional Series

It’s long been a given, that the next installment in my series on personal heroes would have to be an astronaut. The only reason I chose to put Babbage in pole position was to avoid the blindingly obvious.

The dilemma was always which one. Well the events of recent days, and the general Internet hum at the passing of Neil Armstrong has rather forced my hand in the matter. As well as being easily the most famous member of the astronaut corps – certainly to the man in the street – Armstrong was also, superficially at least, one of the least interesting. Quiet and reclusive, had Neil survived his heart surgery of a few days ago, I might easily have chosen one of the lesser known members of that elite but rapidly shrinking group of Apollo moon voyagers. Again to avoid the obvious.

Perhaps the wise-cracking and fun-loving Pete Conrad, who laughed and joked his way to the moon and back on Apollo 12. Or maybe the gruff and stoic Frank Borman, a largely unsung hero who commanded the audacious and hugely dangerous first circumlunar voyage, in an unproven Apollo spacecraft, riding the lightning atop the then un-flown 2.5 million kg flying bomb which was the Saturn V launch vehicle.

Most likely I would have gone with Gus Grissom. One of the original Mercury Seven, Grissom was a veteran of Mercury/Liberty Bell 7 and commanded the Gemini III flight. As NASA’s most experienced astronaut with a reputation for a cool head in a crisis, Grissom was the natural choice to command the very first Apollo mission, and had he not perished in the horrific launch pad fire that also claimed crew mates Ed White and Roger Chaffee in January of 1967, he would almost certainly have gone on to be the first man on the moon.

Neil Armstrong. The Unlikely Hero.

1930 – 2012

But here we are in the southern spring of 2012, over forty years after that hot July night where I sat on the shag-pile rug in front of a black & white TV and watched history unfold. Of the twelve men who walked on the face of the moon in those few short years between 1969 and 1972, and with Armstrong’s passing, I think only five are still alive. It’s a sombre thought that after just a few more summers, there will be no-one left alive who will be able to describe for us what it was like to make that journey and walk that walk.

It seems to be one of the great ironies of life that those who find themselves thrust into the spotlight, the blinding glare of public scrutiny and adoration, are often those least well equipped to handle that attention. Neil Armstrong was certainly such a man. To describe his as quiet and self contained would be an understatement. Unlike many of the other early astronaut candidates, he wasn’t a fighter-jock. He didn’t buy into the rock star lifestyle. He didn’t race a Corvette along the dusty roads of Florida’s East Coast. He didn’t frequent the hotels and cocktail bars of Coccoa Beach a short drive from the The Cape, where wide-eyed young women were queing up to catch themselves a spaceman.

More likely than not, you would find Neil back in his spartan quarters, studying an engineering textbook and planning an early night. In a more media savvy age, NASA would have realised that the first man they chose to send to the moon, would overnight become the most famous human on the planet. They would no doubt chose someone with the appropriate skills and attributes, and carefully groom and prepare him for the circus which was coming to town.

But this was the sixties. I don’t think it ever even crossed their mind. All eyes were on the goal, and although attractively cloaked in the warm, fuzzy “We came in peace for all mankind” NASA disguise, this was still, to all intents and purposes a military operation. There was an enemy to be beaten, and as Gagarin’s recent fall from grace (and eventual suspicious death) had demonstrated before, individuals were expendable. I’m not suggesting for a moment that Armstrong, was deliberately thrown to the wolves, but it’s well known that he, Aldrin, and several others of the group struggled to adjust to their new found celebrity status, and a return to life on planet earth. And nobody, least of all NASA seemed much interested in helping or supporting them.

So why did they pick Armstrong? Well quite simply, he was the safest pair of hands they had at their disposal. Crews were assigned to missions many months in advance, so there was always going to be an element of uncertainty – the Apollo program was a carefully planned sequence of cause and effect, each mission objective had to be completed successfully before the next step could be taken. Although Apollo 11 was ear-marked to be the first landing attempt, if any of the proceeding missions had been unsuccessful, then that task would have fallen to a later flight.

There is, I think a common perception, because of Armstrong’s rather serious, aloof nature and studious engineering background, that he was somehow less of an action-man than some of his more gung-ho compadres. Nothing could be further from the truth. A born aviator, who earned his pilot’s licence at 15, Armstrong was all about action. About getting the task done. As a young navy pilot flying combat missions over Korea, or later as an elite test pilot flying top-secret x-planes at Edwards Air Force Base in the Mojave Desert he approached dangerous, high-risk situations with a cold, analytical methodology which brought him safely out of close calls where pure adrenalin and testosterone probably wouldn’t have. Even before being selected as an astronaut, Armstrong flew to the very edge of space on several occasions as test pilot of the experimental X-15 space plane.

Edwards, and NASA folklore record several instances of Armstrong’s “ice-man” attitude to danger, most notably where he saved the day – as well as his and fellow astronaut Dave Scot’s skins – by manually wrestling their Gemini spacecraft out of a deadly, out of control end-over-end spin only seconds before they would have otherwise have blacked out.

On another occasion, flying the notoriously hairy and unpredictable “flying-bedstead”, a jet powered contraption designed to mimic the difficult flying characteristics of the Lunar Module, Armstrong lost control of the vehicle.

With admirable calmness, he steered the plummeting machine to a safe trajectory, then ejected only feet from the ground before the aircraft crashed in a mighty fireball. Armstrong landed a few hundred feat away, carefully gathered up his parachute, and cross but unhurt, walked back to his office to write up an accident report.

There was a phrase doing the rounds amongst the clean-cut, cigarette smoking, ex-military types who populated Cape Canaveral in those days. “You sir, are a steely-eyed Missile Man.” It was the ultimate compliment you could be paid. There were few more steely-eyed than the shy but fearless Neil Armstrong.

So, while not exactly Mr. Charisma, Armstrong was in every other respect, the perfect choice to command the first landing mission. And I truly wonder if anyone else could have pulled it off. Because Apollo 11 is revered as such a historic and successful flight, most people who weren’t directly involved, have either forgotten, or never realised just how close to disaster Armstrong and Aldrin really came. It could have so easily ended very differently.

The final decent to the surface was designed to be largely automated, with Landing Radar steering the LM to a pre-selected landing site that had been determined to be safe. When the craft pitched forward towards the later part of the descent and the crew got their first clear view of the ground, it became apparent to Armstrong and Aldrtin that the rocky landscape rushing a few hundred feet beneath them did not correspond with their charts or simulation training. They were overshooting their planned landing area and heading into a heavily cratered and boulder-strewn wilderness. Armstrong assumed manual control of the craft’s attitude and began searching for a clear area large enough to put down safely. On several occasions the cabin, and Earth-Moon comm’s loops were filled with blaring electronic alarms, as the onboard computer became overloaded, and to add to the pressure, they were rapidly running out of fuel.

“Twenty Seconds” called up Mission Control. That was twenty seconds of gas left in the tanks, including the twenty seconds they needed for a safe abort. Time was up. After that Houston just shut up. It was totally out of their hands. It was all up to Armstrong now.

On the tape recording there is a deafeningly long silence as Armstrong picked his way amongst the craters and car sized rocks. It seems to go on forever. Finally Aldrin reports “kicking up a little dust…” then “contact-light!”

There is another long silence…

Then Armstrong’s voice comes over the crackling com. “Er… Tranquility Base here. The Eagle has landed.” His voice is bloodless and dead-calm. Not a hint of emotion or breathlessness.

Or is there.

I’ve listened to those words so many time over the years, and again now. And I think if you listen carefully there is something about the way he says “The Eagle has landed”, something about the subtle modulation and inflection in his delivery, that is more than just a missing pilot reporting in. An engineer laying out the facts.

Is that pride? An iota of excitement even. I’d like to think so.

on the end just in case you’ve overstepped the mark.

on the end just in case you’ve overstepped the mark.

The name

The name

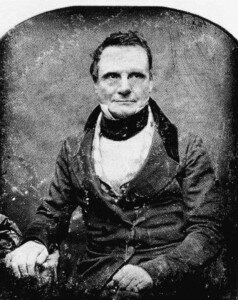

Babbage’s greatest flaw, and ultimately his undoing, was his relentless perfectionism. Frustrated by his workman’s inability to machine parts to the exacting tolerances that his specifications demanded, he continually refined his designs and manufacturing processes. He would spend months and years perfecting a mechanism, only to later abandon it in favor of a new improved design. Eventually his backers tired of the constant delays and cut his funding. He continued to work on The Difference Engine for the rest of his life, and although a fully working engine was never completed in his lifetime, Babbage left hundreds of detailed and beautiful engineering drawings, manuscripts, countless notebooks and several working fragments and demonstration pieces of his creation.

Babbage’s greatest flaw, and ultimately his undoing, was his relentless perfectionism. Frustrated by his workman’s inability to machine parts to the exacting tolerances that his specifications demanded, he continually refined his designs and manufacturing processes. He would spend months and years perfecting a mechanism, only to later abandon it in favor of a new improved design. Eventually his backers tired of the constant delays and cut his funding. He continued to work on The Difference Engine for the rest of his life, and although a fully working engine was never completed in his lifetime, Babbage left hundreds of detailed and beautiful engineering drawings, manuscripts, countless notebooks and several working fragments and demonstration pieces of his creation.